-

2024-04

19

“‘茶科技’前沿与省重点实验室参观”专业教育活...

为加深茶学专业学生对专业和学科的认识、激发科研兴趣, 4月15日和17日...

-

2024-04

17

网投比较靠谱的网站召开本科教育教学审核评估推进会

为迎接本科教育教学审核评估,4月15日下午,网投比较靠谱的网站本科教育教学审核评估工...

-

2024-04

16

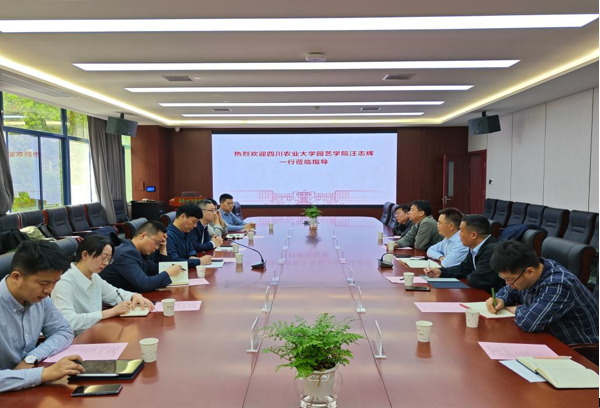

院长汪志辉带队赴华中农业大学学习交流

为进一步加强与对标竞进单位华中农业大学的交流互动,4月12--14日,院长...

-

2024-04

15

网投比较靠谱的网站实践团队把行走的思政课堂开在田间地头

近日,网投比较靠谱的网站江油实践团队前往江油市方水乡白玉村开展红色宣讲并对桃子、...